A 5-step roadmap to successfully integrate accounting outsourcing support into your firm

Introduction:

If growing your client base is part of your plan and you have decided that outsourcing some of your accounting tasks is the best way to achieve it, the next step is putting it into action with a process that works. This blog post outlines five steps to guide you through the accounting outsourcing process and set your firm on a path for sustainable growth.

Key takeaways

Assess outsourcing partners based on experience, technology, security, cultural fit, and proven results.

Create a detailed Scope of Work outlining tasks, tools, workflows, and turnaround expectations.

Formalise agreements with clear service standards, compliance requirements,s and communication protocols.

Choose the outsourcing model that fits your needs, whether project-based or dedicated resource.

Best ways to integrate accounting outsourcing support into your firm

These five steps will help you successfully bring accounting outsourcing into your operations

Step 1: Define your objectives and choose the right partner

A successful outsourcing arrangement begins with a clear understanding of your goals. When you know exactly why you are outsourcing, it becomes easier to focus on what matters most and to select a provider who can deliver the right results for your firm.

Start by identifying your main drivers for outsourcing. These may include:

- Increasing capacity during busy seasons such as year-end or tax time

- Accessing specialised expertise not available in-house

- Improving efficiency and turnaround times

- Controlling or reducing costs without sacrificing quality

Clarifying these priorities will give you a clear benchmark for evaluating potential partners. Once your objectives are defined, review each candidate carefully to determine if they are capable of meeting those needs. Key factors to consider are:

- Relevant accounting experience and understanding of your market

- Technology, infrastructure, and data security measures

- Cultural compatibility to ensure smooth communication and collaboration

- Proven track record supported by client references or case studies

After narrowing down your options, schedule a discovery session with the shortlisted providers. Use this discussion to share your firm’s objectives, walk them through your workflows, and set expectations for service delivery.

At the same time, pay attention to how they explain their processes and how they propose integrating with your operations. This will help you make a confident, informed decision about which partner is the best fit for your outsourcing strategy

Struggling with limited resources?

Learn five proven strategies that can help your firm overcome capacity challenges with ease. in our latest blog post.

Step 2: Define the scope of work and set engagement terms

Once you have selected your outsourcing partner, the next step is to set out exactly what will be done, how it will be done, and the standards that will apply. Without this clarity, it is easy for misunderstandings to arise, leading to delays and frustration for both teams.

Begin with a detailed Scope of Work (SOW). This should outline:

- A breakdown of tasks and responsibilities, grouped by frequency (daily, weekly, monthly)

- The accounting software, tools, and platforms to be used (e.g., Xero, MYOB, QuickBooks)

- Workflow processes and specific handoff points between your local team and the outsourced team

- Turnaround time expectations for each deliverable

- Seasonal workload plans and contingency measures for high-demand periods such as EOFY and tax season

Once the SOW is agreed, formalise the arrangement with an Engagement Letter and a Service Level Agreement (SLA). These documents should clearly specify:

- Start date, contract duration, and termination clauses

- Accuracy standards, acceptable error thresholds, and resolution processes

- Billing terms, payment frequency, and invoicing requirements

- Agreed communication schedules, reporting formats, and escalation procedures

All agreements should comply with Australian legislation, including the Privacy Act 1988 and the Australian Privacy Principles, as well as professional obligations under CPA Australia, CA ANZ, or IPA.

Step 3: Select the right outsourcing model

Choosing the right outsourcing model starts with understanding how much support you need, the type of work to be completed, and the level of control you want over day-to-day tasks. Some businesses prefer short-term help for specific projects, while others need ongoing support as part of their regular operations.

To meet these different needs, we offer two flexible outsourced accounting models.

The project-based model is best for clearly defined assignments such as bookkeeping, BAS, payroll, tax returns, financial statements, SMSF administration, or ASIC compliance. You can choose hourly billing, fixed fee, or a hybrid arrangement, with no long-term contracts or minimum commitments. Work can be completed under your brand or ours, ensuring a seamless fit with your existing processes.istency over time matters more than one-off results.

The dedicated resource model is ideal for firms that want virtual accountants or bookkeepers working exclusively for them. This cost-effective arrangement lets you commit to either 20 or 40 hours per week at a flat monthly fee. We ensure smooth onboarding, provide continuous managerial support, and quickly replace team members if there is turnover, so your operations remain consistent and disruption is minimised.

Whichever model you choose, our goal is to ensure your accounting function runs smoothly, efficiently, and with complete peace of mind.

Want expert help to determine the best outsourcing model for your operations?

Connect with our team to develop a customised plan that works for you.

Step 4: Engage your internal team and establish communication protocols

Your internal team is central to making outsourcing a success. Involving them early builds trust, reduces resistance, and ensures they see the arrangement as an opportunity rather than a threat.

Start by communicating the strategy clearly so everyone understands the purpose and expected outcomes.

- Explain why outsourcing is being introduced and the benefits it will bring to the firm and to staff.

- Where possible, reassure employees about job security.

- Position outsourcing as a way to free them from repetitive work so they can focus on higher-value, client-focused activities.

Once the strategy is understood, actively involve the team in shaping how the arrangement will work.

- Ask staff to identify tasks that could be effectively outsourced.

- Invite them to help prepare training materials, process guides, and checklists for the offshore team.

With the team engaged, set up clear communication and reporting protocols so that work flows smoothly between locations.

- Schedule regular meetings, such as daily check-ins for task updates or weekly reviews for progress and quality. Select collaboration tools that both teams can access easily, such as Microsoft Teams, Slack, or Zoom.

- Define standard reporting formats, turnaround times, and escalation processes for resolving issues.

Before fully rolling out the arrangement, conduct a pilot phase to test processes and communication.

- Run a two to four-week trial, limiting the scope to a manageable set of tasks.

- Use this time to identify gaps, address problems, and refine workflows before expanding the arrangement.

By bringing your team into the process from the start and giving them a voice in how outsourcing is implemented, you build a stronger, more cooperative working relationship between local and offshore teams.

Step 5: Implement securely, monitor performance, and scale

Once outsourcing is in place, the focus moves from planning to execution. At this stage, attention should be on protecting systems, tracking performance, and refining processes to support ongoing improvement.

Start by ensuring data security measures security measures are embedded from day one.

- Use encrypted file storage and secure transfer methods for all documents.

- Apply role-based access controls and two-factor authentication to protect systems.

- Limit system access to approved locations or IP addresses to reduce risk.

With security in place, actively monitor performance to confirm that service levels are being met.

- Track turnaround times to ensure deadlines are consistently achieved.

- Measure accuracy and error rates against agreed targets.

- Assess the quality and clarity of communication between teams.

- Gather feedback from your internal staff on how the arrangement is working in practice.

Review results regularly and refine as needed.

- Hold monthly performance reviews during the early stages, moving to quarterly once processes are stable.

- Adjust workloads, refine workflows, and reallocate staffing as your needs change.

When the arrangement is operating smoothly, look for opportunities to scale strategically.

- Expand the scope during peak demand periods such as EOFY and tax season.

- Introduce new services gradually to maintain quality and control.

By securing systems, tracking results, and making measured adjustments, you can create a stable outsourcing arrangement that delivers consistent benefits, supports your firm’s growth, and maintains the high service standards your clients expect.

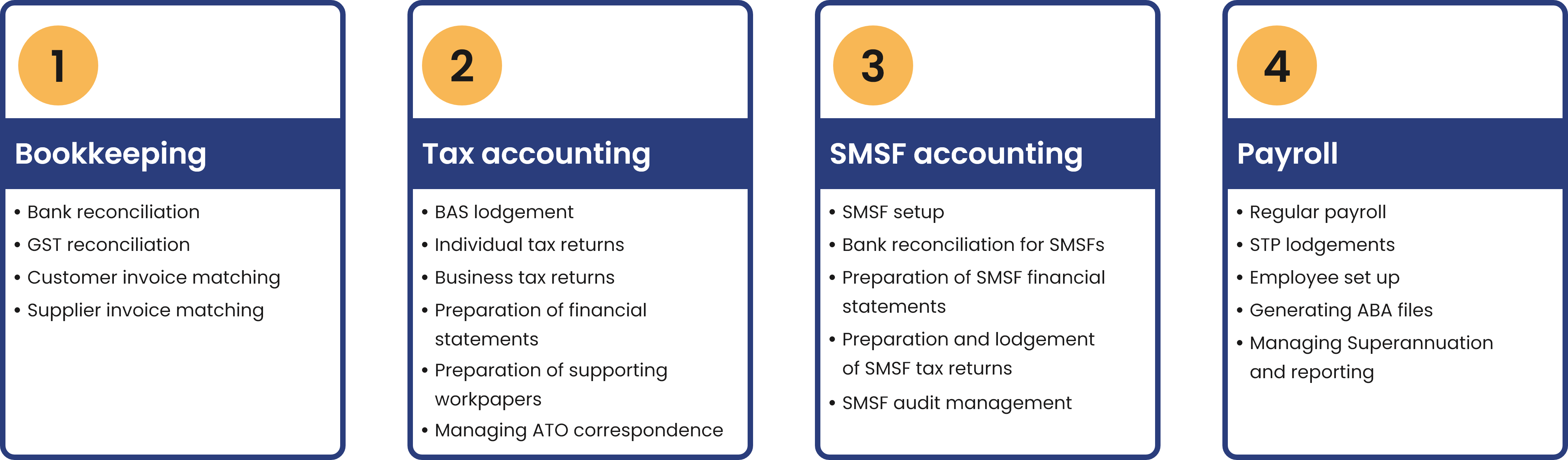

What can you outsource to AccountGlobal?

Here is the list of accounting services you can outsource to AccountGlobal:

Final thoughts

By following the five steps discussed above with commitment and consistency, your firm can unlock significant advantages through outsourcing. These benefits include increased capacity to handle more clients, a substantial reduction in time spent on administrative tasks, and improved profit margins through better use of resources.

At AccountGlobal, we have partnered with accounting and bookkeeping firms to achieve these results. Our approach combines streamlined processes, access to skilled offshore professionals, and secure systems that ensure work is done accurately, confidentially, and on time. This setup lets your firm focus on higher-value client work while we take care of the regular back-office tasks.

If you want to see similar results and build a plan that supports your firm’s growth, book a consultation with us today. Together, we will create a tailored outsourcing solution that meets your goals and helps your business thrive.