5 capacity planning strategies that help firms scale without stress

Introduction:

The accounting industry is struggling to attract and retain talent. Almost half of accountants (41 per cent) believe talent shortages will continue to affect the profession, and 45 per cent of firms say staffing gaps are making it difficult to meet client expectations while protecting work-life balance.

The growing shortage of talent calls for strategic and forward-thinking approaches to capacity planning. For many firms, this includes outsourcing accounting to ensure the continued growth and long-term success of accounting practices.

In this article, we will examine the capacity challenges currently facing the accounting industry and share five strategies firms can use to manage workloads, support their teams, and strengthen operational efficiency.

Key takeaways

Talent shortages are creating ongoing capacity pressure across the accounting industry.

Capacity planning helps align workloads with available resources to reduce burnout and delays.

Planning ahead with workload forecasting prevents overload before it happens.

Removing unproductive clients frees up time for more valuable relationships.

Outsourcing gives your firm the flexibility to scale support up or down based on seasonal peaks or shifting demands.

What is capacity planning, and how does it help?

Capacity planning is the process of assessing how much work your team can realistically handle and making sure your resources are properly aligned with that workload.

Here are the ways capacity planning adds value to your firm:

- It reduces staff overload and burnout by keeping workloads realistic and balanced across the team.

- It improves your ability to meet deadlines and deliver consistent results by aligning resources with actual demand.

- It helps you assign work more strategically by matching tasks with each person’s skills and availability.

- It supports smarter staffing decisions by identifying when and where additional resources are needed.

- It increases efficiency by minimising idle time and reducing delays in your workflow.

- It enhances team morale and retention by maintaining a manageable workload and a healthier work environment.

- It enables you to grow your firm with confidence, knowing your team can handle new clients and higher volumes without being overstretched.

Now that you have seen the incredible benefits capacity management can bring, let’s look at how you can improve your capacity.

Need help with bookkeeping, payroll, SMSF, or tax returns?

Schedule a call with our offshore accounting specialist today and get flexible support that helps your team meet deadlines.

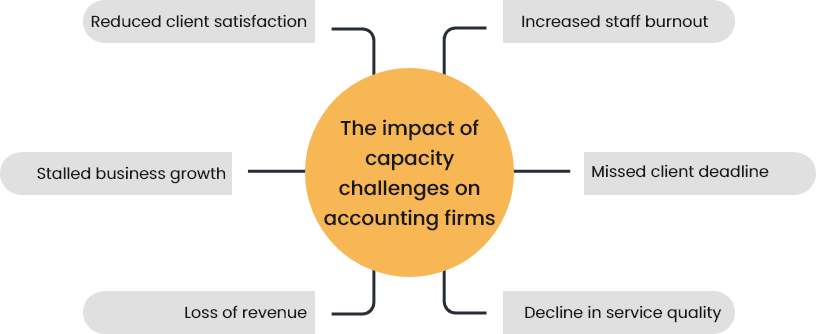

Why do so many accounting firms struggle with capacity?

Capacity problems don’t appear overnight. They build up through everyday inefficiencies and missed opportunities to plan ahead. For many firms, the issue comes down to four recurring challenges:

Planning is constantly delayed

During busy periods, there’s little time to step back and assess whether your team can actually keep up with the work. With client lodgements, compliance deadlines, and meetings taking priority, capacity planning is often pushed aside. As a result, firms continue to operate in a reactive mode, never quite catching up.

Hiring happens too late

Most firms make recruitment decisions only after the pressure builds. Without a clear view of future workload or resourcing needs, hiring becomes a short-term fix. This often leads to misaligned roles, rushed onboarding, or an unbalanced team that’s hard to manage efficiently.

Skilled staff are tied up with low-value tasks

Accountants regularly lose over an hour each day to administrative work that could be handled by support staff. Over time, this has a compounding effect on productivity. The more time senior team members spend on basic tasks, the less capacity your firm has for billable or strategic work.

Workflow systems are inconsistent or outdated

When processes vary from person to person, work takes longer to complete, and errors become more frequent. Without standardised systems and cloud-based tools, it becomes difficult to delegate, track progress, or scale operations smoothly. This lack of structure limits both output and team performance.

When these challenges go unaddressed, they don’t just slow you down; they restrict your firm’s ability to grow, take on new clients, and deliver consistent results. That’s why solving capacity issues requires more than short-term fixes. It calls for a long-term, intentional strategy.

5 ways to solve capacity challenges

Here are some recommendations to help you solve capacity challenges and position your firm for sustainable success in 2025 and beyond.

Plan capacity before you hit a breaking point

Begin by reviewing all confirmed and recurring client work scheduled for the weeks ahead. As you break down each job into estimated hours and assign them across your team, consider how this workload fits within their actual availability.

While doing this, also factor in potential scenarios that could disrupt the plan, such as a staff member taking leave, a client requesting early delivery, or multiple complex jobs overlapping unexpectedly.

Including these possibilities during the planning stage helps you identify where capacity may become stretched before it happens. It also allows you to test whether your current schedule can absorb changes without pushing deadlines or overloading individuals.

By pairing accurate forecasting with basic what-if planning, you give your firm the flexibility to adapt early, rather than react late. This leads to more confident scheduling, fewer last-minute reshuffles, and better outcomes for both your team and your clients.

Let go of clients that drain your capacity

Not every client relationship is worth holding on to. Some consistently slow things down, take up more time than they should, and distract your team from work that truly matters.

Take a closer look at your current client list. Identify which relationships support the growth of your firm and which ones create ongoing complications. If a client regularly ignores processes, delays deliverables, or demands more than agreed, it may be time to reset expectations or move on.

Clearing out unproductive accounts gives your team more breathing room. With fewer disruptions, you can deliver better work, strengthen valuable partnerships, and create space for new opportunities that align with your goals.

Standardise your processes to reduce inefficiencies

Many capacity issues stem from inconsistent ways of working. When tasks are handled differently by each team member, it leads to delays, errors, and extra reviews. Standardising your internal processes creates predictability and saves time. Begin by identifying your most frequent services, such as tax returns, BAS lodgements, or monthly reporting.

Develop step-by-step checklists, reusable templates, and clear handover procedures so that each task is completed the same way, regardless of who is assigned to it. This not only improves accuracy but also reduces onboarding time for new staff and makes it easier to shift tasks between team members during peak periods.

Automate your time-consuming process

Automation is no longer a future concept in accounting. It is already here, and the firms using it wisely are the ones staying ahead.

But with so many tools available, the goal should not be to adopt more software; it should be to reduce manual effort and streamline work. The first step is to map out your internal processes in detail. Once you clearly see what your team is doing each day, it becomes easier to spot repetitive tasks that are perfect for automation.

Start small. Focus on the areas that take up time but do not need constant input, such as bookkeeping, tax preparation, data entry, document collection, and other administrative tasks. Automating these low-touch tasks gives your team more capacity for meaningful work, especially client communication and advisory.

Keep in mind, adding a tool should solve a problem, not create more layers. The best automations are the ones that quietly take care of the background work and make everything else flow better.

Outsource to relieve internal pressure

The most well-organised approach to deal with overcapacity is to choose outsourcing. It allows your firm to delegate work to professionals who not only have the right skills but also the time and capacity to handle it efficiently.

Here’s how outsourcing can support your operations:

- Controls operational costs by reducing the need for full-time hires, infrastructure, and administrative overhead

- Offers workforce flexibility so you can scale support up or down based on seasonal demands or business changes.

- Refocuses your internal team on higher-impact responsibilities like client relationships, advisory services, and business development

- Supports consistent delivery by helping you manage volume without compromising quality or timelines

With a well-chosen outsourcing partner, your firm can improve efficiency, protect team wellbeing, and grow sustainably without pushing internal capacity beyond its limit.

Together, these five solutions give you a structured approach to resolving capacity issues without rushing to hire or overloading your existing team. When implemented consistently, they create a more resilient firm that can grow, adapt, and deliver — even during the busiest times of year

Running out of capacity? Here’s how AccountGlobal’s offshore accounting support can help

When your in-house team is stretched thin and the workload keeps growing, AccountGlobal offers an offshore solution to restore balance and drive progress.

Managed locally from Sydney and supported by a team of over 120 professionals, we offer the additional capacity you need without compromising quality, control, or compliance.

Our offshore services are designed to integrate seamlessly with your systems and processes. Whether you are looking for support with bookkeeping, payroll, tax returns, or SMSF accounting, our team works alongside yours to maintain performance, reduce pressure, and create room for growth.

You can choose from three flexible models to match your business needs:

- The project-based model allows you to outsource specific jobs, such as tax returns, BAS, or financial statements, on a per-file basis with no ongoing commitment

- The dedicated resource model gives you a virtual accountant who works exclusively for your firm on either a part-time or full-time basis

- The offshore team model lets you build a customised group of accountants, bookkeepers, and SMSF specialists, fully recruited and managed by us

In addition to flexibility, our services are fully compliant with Australian standards. All work is performed under ATO-aligned processes, supported by ISO 27001-certified data security systems that protect client information at every step.

Our professionals are experienced with all major accounting platforms, so no additional training or disruption is required. If capacity issues are slowing your growth or affecting team wellbeing, get in touch with us today.