The ATO's new PAYGW prefill initiative for activity statements

Introduction:

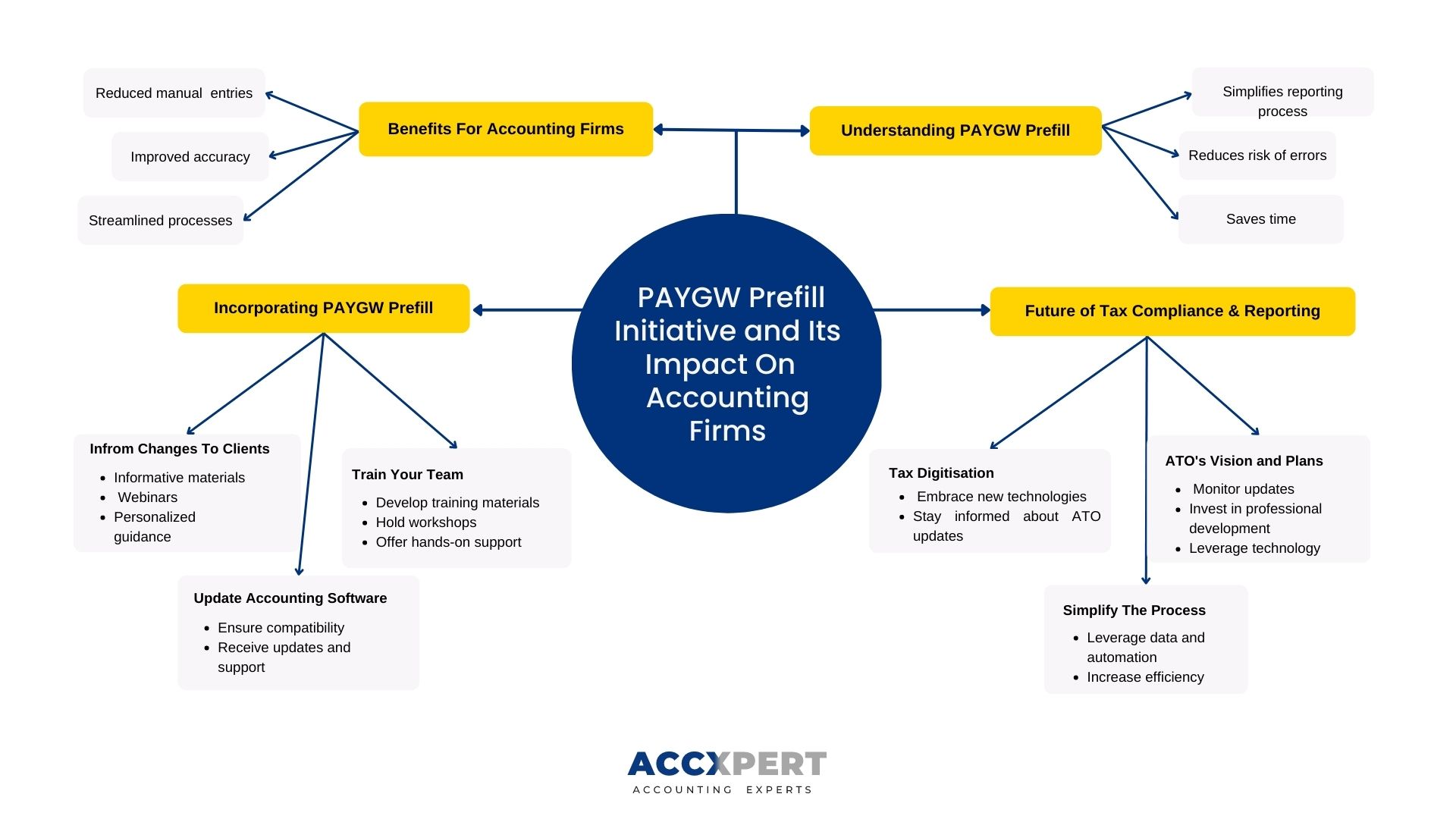

The Australian Taxation Office (ATO) has recently introduced the PAYGW (Pay As You Go Withholding) prefill feature for activity statements, a move that will simplify the tax reporting process for businesses and accounting firms alike.

In this comprehensive blog, we'll explore the key aspects of this new initiative, discuss its implications for accounting firms, and offer guidance on how to implement this change in your practice.

Understanding PAYGW prefill in activity statements

The ATO's effort to simplify reporting for businesses

The PAYGW prefill initiative is designed to streamline the reporting process for businesses by automatically populating their activity statements with relevant PAYGW data. This new feature aims to reduce the risk of errors, save time, and alleviate the administrative burden that comes with tax reporting, allowing businesses and their accounting professionals to focus on more strategic tasks.

Key features of the PAYGW prefill in activity statements

The primary feature of the PAYGW prefill is the automatic population of activity statements with PAYGW data, reducing manual data entry requirements. By drawing the relevant data directly from the ATO's systems, the prefill ensures that businesses have access to accurate and up-to-date information when completing their activity statements.

In addition to improved accuracy, the PAYGW prefill offers several other key benefits:

- Enhanced visibility of PAYGW data, making it easier for businesses to ensure they are meeting their tax obligations.

- Time savings, as businesses and their accounting professionals no longer need to spend time gathering and inputting data manually.

- Reduced risk of errors and potential penalties, as the prefill draws on accurate data directly from the ATO.

- Streamlined processes, allowing firms to focus on more value-added services for their clients.

These benefits can ultimately lead to increased efficiency and competitiveness for accounting firms, as they are better able to serve their clients and manage their own resources.

How to incorporate PAYGW prefill in your accounting practice?

Updating your accounting software

To take advantage of the PAYGW prefill feature, it's crucial to ensure your accounting software is updated and compatible with the ATO's systems. Contact your software provider to confirm compatibility and complete any necessary updates.

When choosing or updating your accounting software, consider the following factors:

- The software's integration with the ATO's systems, ensuring seamless data transfer and access to the PAYGW prefill functionality.

- The ease of use and user experience provided by the software, as this can impact the efficiency of your team and their ability to serve clients.

- The availability of ongoing support and updates from the software provider, ensuring that your practice remains up-to-date with the latest changes and requirements.

Training your team to utilise PAYGW prefill

Once your software is updated, it's important to train your staff on the new PAYGW prefill feature. This will help ensure that your team can effectively utilise the new functionality and provide the best possible service to your clients. Consider the following steps when training your team:

- Develop clear and concise training materials that explain the PAYGW prefill feature and its benefits.

- Hold training sessions or workshops to guide your team through the process of using the PAYGW prefill functionality in your accounting software.

- Provide opportunities for hands-on practice, allowing your team to become comfortable with the new feature before implementing it in their day-to-day work.

- Encourage open communication and feedback, as this will allow you to address any concerns or difficulties your team may encounter while using the PAYGW prefill functionality.

- Consider ongoing training and support, ensuring that your team stays informed about any changes or updates to the PAYGW prefill feature and can effectively adapt their practices as needed.

Communicating the changes to your clients

Finally, inform your clients of the new PAYGW prefill initiative and its benefits. Clear communication will help your clients understand how this change will impact their business and streamline their reporting process. Consider the following strategies for communicating the changes to your clients:

- Create informative materials, such as blog posts or email newsletters, that explain the PAYGW prefill initiative and its benefits.

- Offer webinars or informational sessions where clients can learn more about the new feature and ask questions.

- Provide personalised guidance, working closely with your clients to ensure they understand how the PAYGW prefill feature will impact their specific situation.

- Encourage feedback and maintain an open dialogue, allowing clients to voice any concerns or questions they may have about the PAYGW prefill initiative.

The future of tax compliance and reporting in Australia

Streamlining the tax compliance process

The ATO's introduction of the PAYGW prefill is another step towards a more streamlined tax compliance process. As technology continues to advance, we can expect further innovations that will simplify reporting and compliance for businesses and accounting professionals alike. For example, the ATO is likely to continue exploring new ways to leverage data and automation to reduce manual processes, increase efficiency, and minimise the risk of errors.

Adapting to the digital transformation of taxation

As the digital transformation of taxation continues, accounting firms must adapt to the evolving landscape by embracing new technologies and staying informed about the latest ATO initiatives. Firms that can quickly adapt to these changes will be better positioned to provide efficient and value-added services to their clients.

To stay ahead in the digital age, consider the following strategies for your accounting practice:

- Regularly evaluate your technology and software solutions to ensure they are up-to-date and compatible with the latest ATO requirements.

- Invest in staff training and professional development to keep your team knowledgeable about new technologies and processes.

- Embrace a culture of innovation and continuous improvement, encouraging your team to explore new ways to leverage technology in their work.

- Stay informed about industry trends and ATO updates, ensuring that your practice remains prepared for future changes.

Preparing for further ATO initiatives

The PAYGW prefill is just one of many initiatives the ATO is likely to introduce in the coming years. To stay ahead of the curve, accounting firms should closely monitor new ATO updates, invest in ongoing professional development, and seek opportunities to leverage technology in their practices.

To prepare for future ATO initiatives, consider the following strategies:

- Join industry associations and attend conferences, workshops, and webinars to stay informed about the latest developments in taxation and compliance.

- Network with other professionals and industry experts to gain insights and share best practices for adapting to new ATO initiatives.

- Collaborate with software providers and technology partners to stay informed about new solutions and developments that can benefit your practice.

Book a call with our tax experts to make the tax season stress free for your clients!

Book a call

Conclusion

The ATO's PAYGW prefill initiative offers significant benefits to Australian accounting firms, streamlining the reporting process and reducing the risk of errors. By incorporating this new feature into your practice, updating your accounting software, and effectively communicating these changes to your clients, you'll be well-equipped to navigate the ever-evolving world of tax compliance and reporting. Stay informed about the latest developments and embrace the digital transformation of taxation to ensure the continued success of your accounting firm.

By proactively addressing the challenges and opportunities presented by the digital transformation of taxation, your firm can maintain a competitive edge and better serve your clients. Embrace the ATO's PAYGW prefill initiative and other forthcoming changes, and continue to innovate and adapt in order to thrive in the dynamic landscape of Australian tax compliance and reporting.

With the right strategies in place, your accounting firm can not only navigate the challenges of the digital age, but also capitalise on new opportunities to provide value-added services and foster lasting relationships with your clients. By staying informed, embracing new technologies, and fostering a culture of innovation, your practice will be well-positioned to succeed in the evolving world of Australian taxation.