6 KPIs accounting firms should track to measure success in 2025

Introduction:

The revenue coming into your accounting firm plays a major role in shaping your overall success. It is important to understand it from every angle, not just how much is being earned, but how quickly it arrives, how consistent it is, and where changes are happening.

You might be bringing in new clients, but are existing ones staying? Is income spread evenly across your services, or is one area doing all the work? Are payments arriving on time, or are delays putting pressure on cash flow?

To help you assess what is really happening across your firm, we have selected six key performance indicators. Each one reveals something important about how your firm is operating, helping you track results, spot patterns, and make informed decisions that support your long-term goals.

Key takeaways

Tracking KPIs enables accounting firms to measure performance, identify gaps, and make informed business decisions.

Monthly Recurring Revenue reflects income stability and helps with forecasting, pricing strategy, and more

Gross Profit Margin indicates whether service delivery is cost-effective and sustainable over time.

Choosing the right KPIs ensures your firm focuses on metrics that align with strategic goals and operational needs.

Outsourcing helps your firm scale services, improve workflow efficiency, and meet growing client expectations with confidence.

Why is it important for accounting firms to track KPIs?

Here are a few reasons why tracking KPIs matters for accounting firms:

- Tracking KPIs helps guide decisions based on facts rather than assumptions.

- They make it easier to measure whether your efforts are leading to positive outcomes.

- Regular tracking brings focus to areas that may be underperforming or need improvement.

- When goals are measurable, teams stay aligned and work with greater purpose.

- KPIs reduce uncertainty and help you understand how your firm is progressing.

- They support better planning by showing what’s working and where to adjust.

- Over time, they help refine processes and lead to more consistent performance.

With so many metrics available, choosing the right KPIs can be challenging. The goal is not to track everything, but to focus on the ones that align with your firm’s priorities. Monitoring the wrong indicators can create confusion, while the right ones help you see where progress is happening or where improvement is needed.

Start by asking a few important questions:

- Which part of the business needs improvement?

- Are clients continuing to work with you over time?

- Are your services bringing in enough value for the time and effort involved?

By aligning each KPI with a goal, you get insights that help guide smarter decisions and drive long-term performance.

List of Top 6 KPIs accounting firms should track

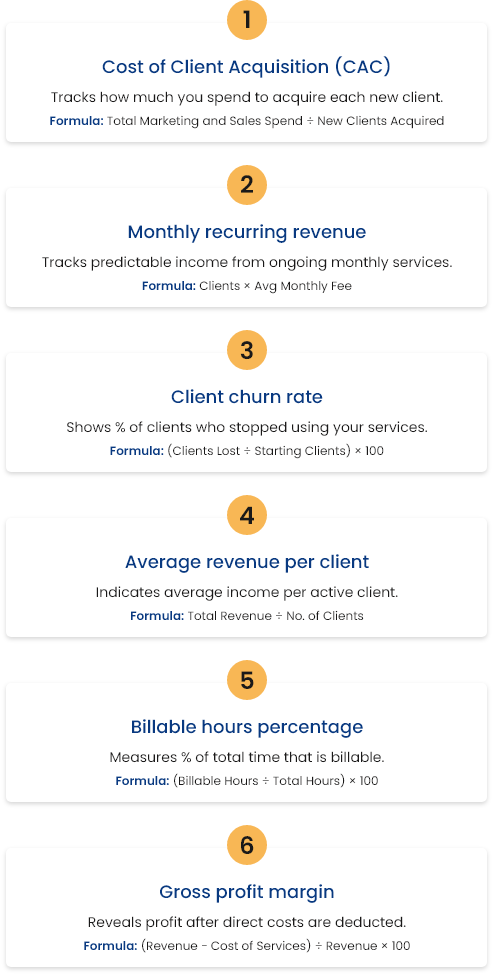

Here are six key performance indicators that can help you assess how your firm is operating, identify areas for improvement, and support more informed decision-making.

1. Cost of client acquisition

Cost of client acquisition, or CAC, shows how much your firm spends to bring in each new client. It includes all sales and marketing costs, such as advertising, software, content creation, training, and the portion of staff wages tied to client acquisition.

This metric helps you understand whether your growth efforts are profitable and which channels bring in clients at the best cost.

To calculate CAC, divide your total sales and marketing spend over a period by the number of new clients gained in the following period.

For example, if your firm spent thirty thousand three hundred dollars last quarter and added eight clients this quarter, your CAC would be three thousand seven hundred and eighty-seven dollars.

Tracking this over time helps you improve marketing performance, allocate resources more effectively, and make smarter decisions about where to invest next.

2. Monthly recurring revenue

Monthly Recurring Revenue, often referred to as MRR, is the total income your firm receives every month from clients under fixed, ongoing service agreements. This includes consistent services such as bookkeeping, payroll, and compliance. It excludes one-time or ad-hoc work.

MRR matters because it reflects the financial stability of your practice. A high or increasing MRR shows that your services are delivering lasting value and that your firm can rely on a steady income stream. It supports better forecasting, budgeting, and strategic planning.

To calculate MRR, multiply the number of clients on monthly plans by the average monthly fee.

For example, 50 clients each paying $800 results in an MRR of $40,000.

Changes in MRR provide early signals. Growth usually comes from onboarding new clients or expanding services. A decline may point to lost accounts or reduced scope. By tracking MRR regularly, you can spot shifts early and respond quickly.

Segmenting MRR by service type or client group helps identify what’s driving revenue and where adjustments may be needed. This allows you to refine pricing, prioritize high-value services, and strengthen recurring income over time.

3. Client churn rate

Client churn rate represents the percentage of clients your firm has lost over a specific period. It is also referred to as your attrition rate and helps you understand how well you are retaining your ongoing client base. Unlike churned revenue, which focuses on the dollar value lost, this metric tracks the actual number of clients who stop using your services.

This is most useful when applied to regular, recurring clients. One-off or project-based clients are generally excluded, since they are not expected to stay with your firm over the long term.

Measuring your client churn rate helps you see how much client loss is affecting your growth. In order for your firm to grow steadily, the number of new clients you bring in must be greater than the number you are losing. If your churn rate starts to rise over time, it may signal problems in your onboarding, communication, service quality, or pricing structure.

To calculate client churn rate, divide the number of clients lost during the period by the number of clients your firm had at the start of that period. Then multiply the result by one hundred to convert it into a percentage.

For example, if one client left during a month where you started with just over thirty clients, your churn rate would be slightly under three percent.

Monitoring this number over time helps you identify patterns in client retention and take action to reduce preventable loss.

4. Average revenue per client

Average Revenue Per Client, or ARPC, represents the amount of revenue your firm earns from each client on average. It helps you understand whether your practice is growing through a few high-value clients or through a larger number of smaller ones.

If your firm focuses on clients who use full-service packages like bookkeeping, BAS, payroll, and ongoing advisory, your ARPC will generally be higher. These clients pay more each month and often stay longer because of the value they receive.

On the other hand, if you primarily work with clients who only need basic compliance support, your ARPC may be lower, and your business may rely more on volume.

This metric helps you assess whether your pricing, service structure, and client targeting are aligned with your business goals. It also gives you insight into how changes in your client base or offerings affect your overall revenue.

To calculate ARPC, divide your total monthly revenue by the number of active clients.

For example, if your monthly revenue is thirty-seven thousand two hundred dollars and you have thirty-five clients, your ARPC would be one thousand and sixty-three dollars.

5. Billable hours percentage

Billable hours percentage shows how much of your team’s total working time is spent on client work that can be invoiced. It helps measure how efficiently time is being turned into revenue. A low percentage may indicate time is being spent on internal tasks, admin, or poorly allocated work that does not directly generate income. This metric helps you identify where time is being underused and where processes can be improved.

To calculate it, divide billable hours by total hours worked and multiply by one hundred.

For example, if a team member works one hundred and sixty hours in a month and one hundred and thirty of those are billable, the billable hours percentage is just over eighty-one percent.

A target of seventy-five percent or higher is usually considered strong for team members who spend most of their time on client jobs. Tracking this regularly helps ensure time is being used effectively and revenue potential is being maximised.

6. Gross profit margin

Gross profit margin measures the percentage of revenue that remains after covering direct service costs. These costs may include staff salaries tied to client work, software used in delivery, or subcontracted services.

This metric helps you assess whether your current pricing is sufficient to cover the cost of operations and still leave room for profit. A declining margin often points to increased expenses or underpriced services.

To calculate: Gross Profit Margin = (Revenue − Cost of Services) ÷ Revenue × 100

If this figure falls below 40%, it may be necessary to review the cost structure, service efficiency, or pricing approach. Monitoring this regularly supports better financial control and helps identify areas where operational adjustments are needed.

How do outsourced accounting services help improve the key metrics of your firm?

Outsourcing accounting functions directly strengthens several areas that determine the success and scalability of your firm. Below are the core performance areas impacted by outsourcing, with specific ways improvement is achieved:

Builds consistent revenue streams

Outsourcing ensures that recurring services such as bookkeeping, payroll, and compliance are completed on time. This helps your firm avoid delays and maintain regular output. With core tasks consistently managed, your team can focus on onboarding new clients and developing service offerings. As a result, your firm is better positioned to grow while keeping income stable month after month.

Enhances client experience and loyaltys

Clients expect consistent, timely, and accurate service. Missed deadlines or repeated errors can damage trust quickly. Outsourced support helps ensure that routine work is completed on time, even during peak periods or when internal staff are unavailable. This reliability helps maintain client satisfaction and encourages long-term loyalty, reducing the pressure to constantly find and onboard new clients.

Lowers recruitment expenses

Recruiting staff involves more than just salaries. The process of advertising roles, interviewing candidates, and training new hires takes time and adds to your costs. Outsourcing allows your firm to avoid these expenses by providing skilled support without going through a full hiring process. This helps you manage your workload while keeping recruitment and onboarding costs to a minimum.

Need extra hands during tax season or ongoing support year-round?

With AccountGlobal, you can outsource on a project basis, bring in part-time help, or build a dedicated offshore team. Book a call today to find the right model for your practice.

Provides flexibility to scale with demand

As your workload increases or shifts, outsourced teams allow you to expand your delivery capacity without long-term commitments. Whether you need support during tax season or while launching new services, this flexibility helps your firm respond to demand without overextending internal resources.

Reduces rework and delays

Experienced outsourced accounting teams often catch errors before they become issues. This lowers the need for back-and-forth corrections, saving time and keeping projects on track.

Final Thoughts

Tracking KPIs like MRR, churn rate, and client retention gives your firm valuable insight into performance, growth, and profitability. But turning that insight into results requires consistent execution and well-managed processes.

This is where AccountGlobal steps in. We provide outsourced accounting and bookkeeping services delivered by an experienced offshore team, fully managed in Sydney. Our team handles bookkeeping, BAS, payroll, tax returns, and SMSF work with accuracy and in full alignment with Australian standards.

You can choose flexible models that fit your firm’s workflow, reduce overheads, and increase capacity without adding recruitment pressure. Book a discovery call to learn more about how AccountGlobal can support your firm.