3 tips to prepare for tax season amid talent shortage

Introduction:

Tax season in Australia is becoming increasingly difficult to manage, not because of client demand, but due to a shrinking pool of qualified professionals. Many firms are entering their busiest period under-resourced, facing tight deadlines with limited internal capacity.

If your firm is experiencing the same strain, now is the time to act. This blog outlines three strategies to help you maintain performance, manage workloads, and support your team through the peak season despite the ongoing talent shortage.

Key takeaways

Retaining your existing team is more cost-effective than hiring new staff.

Replacing a mid-level accountant can cost up to $127,500.

Using tools like Xero, Dext, and Ignition improves efficiency and consistency.

Automation reduces manual tasks and frees up time for higher-value work.

Offshore support allows firms to maintain output without stretching local resources.

Best ways to prepare for tax season amid a talent shortage

Here are three proven strategies to help your firm stay prepared, deliver consistently, and manage the demands of the season effectively:

1. Invest in staff retention and wellbeing:

Supporting your team with the right mix of flexibility, recognition, and learning opportunities is increasingly important as turnover rises and hiring becomes more difficult.

According to a 2025 survey by Chartered Accountants ANZ, taxation accountants now face the highest risk of national shortage, with a vacancy fill rate of just 59 percent. This means that for every 10 open roles, four remain unfilled.

The cost of losing an experienced team member adds further pressure. Research from Robert Half Australia estimates that replacing an employee can cost between 50 to 150 percent of their annual salary. For a mid-level accountant earning $85,000, that’s a loss of between $42,500 and $127,500 in recruitment expenses, onboarding time, lost productivity, and client service disruption (source).

Given these conditions, focusing on the team you already have can deliver greater stability, performance, and long-term value. Here are some practical and cost-effective ways to support and retain your people:

- Pay for courses or certifications that your employees are genuinely interested in and that also support their role or future within the firm.

- Allocate paid time during the workweek for learning and development.

- Promote from within by assigning more advanced responsibilities as employees progress.

- Recognise achievements in visible ways to boost morale and retention.

- Offer time off or flexibility after intense periods like tax season to prevent burnout.

- Maintain open, supportive one-on-one conversations to align career goals with business needs.

- Encourage knowledge sharing within the team to strengthen collective skills and leadership.

With recruitment costs rising and skilled professionals becoming harder to find, retaining the team you already have is one of the most strategic and cost-effective decisions your firm can make.

2. Use automation to save time with the right setup:

There are many ways to apply automation across your accounting and payroll workflows. The more you automate, the more time you can save. Tasks such as calculating wages, processing superannuation, tracking leave balances, issuing invoices, and handling client documents can all be streamlined with the right systems. This reduces manual work and creates more consistent outcomes across your firm.

Researchers have found that firms using automation grow up to 3.3 times faster than those still relying on manual methods. However, automation alone does not ensure accuracy.

A recent report revealed that 42 percent of Australian businesses experienced at least one payroll breach in the past year. This highlights a key risk. Without human oversight, automated systems can produce errors that impact compliance and service quality.

In Australia’s complex regulatory environment, automation must be supported by sound professional judgment. Employment conditions, superannuation rules, and award classifications continue to evolve.

Software can process data efficiently, but it cannot interpret regulations or assess fairness. Your team still needs to review outputs, apply context, and make informed decisions where necessary.

To apply automation effectively, consider using the following tools:

- Xero or QuickBooks Online to automate payroll, invoicing, reconciliations, and financial reporting.

- Hubdoc or Dext to capture and process bills, receipts, and supporting documents.

- Ignition to automate client engagement letters, proposals, and recurring billing.

- FYI Docs or SuiteFiles to manage internal workflows, document storage, and automated task reminders.

- Zapier to connect your apps and trigger automated actions across systems.

- FuseSign to collect secure electronic signatures for client authorisations and compliance forms.

As automation becomes more common, developing your team’s skills is key. Staff need to understand how to manage these systems, verify results, and respond when exceptions arise. A well-trained team ensures your automation efforts support accuracy, compliance, and long-term growth.

3. Expand capacity through offshore support:

Finding qualified accounting staff locally has become increasingly difficult. The talent pool is limited, and many firms face strong competition from larger employers offering higher salaries and broader benefits. This creates challenges for small and mid-sized firms that need reliable staffing without overextending their budgets.

Offshore support offers a viable way to grow your team and maintain output when local hiring options fall short. With access to experienced professionals outside Australia, your firm can delegate time-consuming tasks like bookkeeping, payroll, and compliance support to offshore staff while your local team focuses on reviews, client interaction, and quality control.

Another benefit is the extended workflow. While your local team is offline, your offshore team can continue working, allowing you to begin the next day with key tasks already in motion. This improves turnaround times and helps you stay on schedule, even during peak periods.

To set up offshore support that fits well within your existing operations, follow the steps below:

- Identify recurring, process-based tasks such as reconciliations, payroll processing, and data entry to delegate.

- Use cloud accounting platforms like Xero or QuickBooks Online so both teams can access files in real time.

- Schedule regular video calls through Zoom or Google Meet to stay connected and aligned.

- Use Slack or Missive for day-to-day messaging to reduce inbox clutter and speed up responses.

- Record training and task instructions using Loom to save time and build a shared knowledge base.

- Ensure data security by setting permissions, using encrypted storage, and limiting access to sensitive files.

- Assign a team coordinator to manage workloads, answer questions, and monitor performance.

Offshoring helps you maintain service quality and grow your capacity, especially when local hiring options are limited. With the right systems and support in place, your offshore team becomes a reliable extension of your firm.

Team up with AccountGlobal’s experienced offshore accountants

When local hiring becomes difficult or your internal capacity is under pressure, AccountGlobal is here to support you. We help Australian accounting firms manage growing workloads by providing access to qualified offshore accountants, bookkeepers, SMSF specialists, and tax professionals. All team members are trained to meet ATO standards.

Our senior managers are members of CAANZ, and each offshore accountant is overseen by a supervisor with more than three years of experience in the Australian accounting industry. We understand the local regulatory environment and the expectations firms like yours face every day.

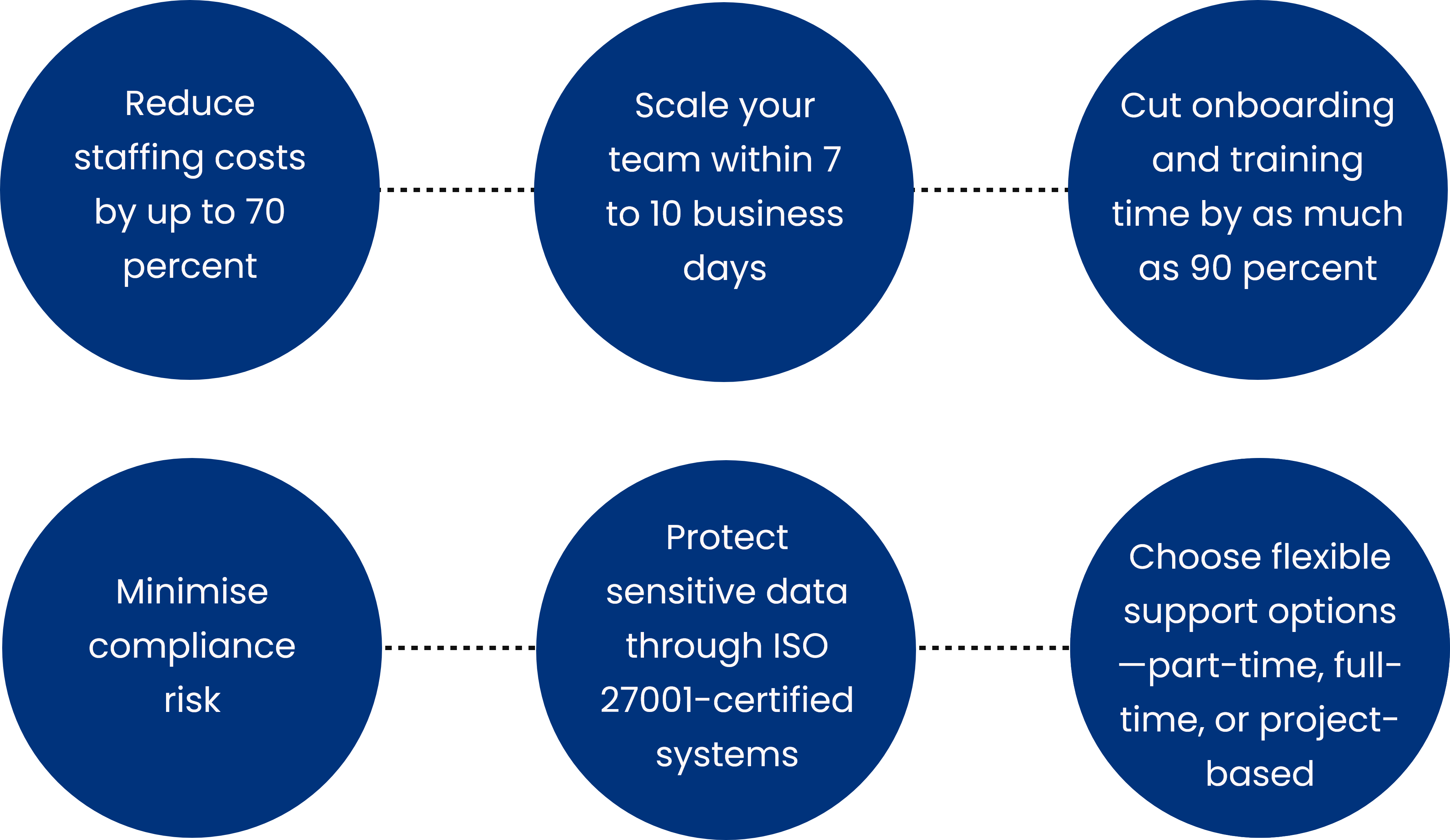

By working with AccountGlobal, your firm can:

Our professionals work within your existing systems, follow your firm’s processes, and help you stay focused on client outcomes while managing costs and capacity with confidence.

Final thoughts

Tax season will always be demanding, but it doesn’t have to come at the cost of your team or the quality of your service. With the right preparation, technology, and reliable support, you can meet deadlines, manage workloads, and maintain performance—even in the busiest months.

If you are considering offshore support for tax and compliance, now is the time to make your move. Connect with AccountGlobal and get the right support in place before the pressure begins.