A stress-free approach to surviving the busy season in your accounting firm

Introduction:

In Australia, the period from July to October is widely recognised as the accounting industry’s busy season. It’s a time filled with tax deadlines, demanding workloads, and spreadsheets that seem never-ending. For many firms, it brings long hours, rising stress, and a scramble to stay on top of everything.

This pressure, however, can become much more manageable with the right strategies.

This blog post outlines simple tips to help your firm manage the busy season efficiently while maintaining a healthy work schedule.

Key takeaways

Set clear deadlines for clients to reduce last-minute stress and ensure timely submissions.

Choose pricing models that reflect the value of your services and support sustainable growth.

Automate repetitive and time-consuming tasks to improve accuracy and save valuable hours.

Outsource routine work to free up internal resources for strategic tasks.

10 strategies for accountants to manage the busy season

Let’s explore how to turn the accounting busy season into just another manageable part of the year:

Set clear deadlines for your clients:

If you have ever had a stressful tax season, the real issue may not have been the work itself but the delays in receiving client information.

Although clients often see tax time as a once-a-year obligation, your firm can operate more efficiently when they stay engaged throughout the year.

Encourage clients to submit documents as they receive them, keep their records organised, and respond promptly to your requests. This helps you prepare in advance, avoid delays, and stay on track with deadlines.

Clients should also understand the consequences of missing important dates. The ATO may issue a Failure to Lodge penalty if they are required to lodge or report by a certain date and fail to do so.

When your clients are consistent and responsive, your team can work more efficiently and avoid the stress that comes from chasing last-minute submissions.

Avoid overload by understanding your team’s capacity:

Most accounting firms are focused on hitting revenue and growth targets. But very few take the time to plan whether their team has the capacity to deliver that work effectively.

Without the right number of people, the right skills, and the right support, even the best opportunities can lead to delays, overwhelmed staff, and disappointed clients.

To avoid this, capacity needs to be planned with intention. It begins with reviewing how much work is expected, how many hours your team can realistically deliver, and whether your systems are supporting or slowing down your team.

From there, you can decide whether to improve workflows, adopt new technology, hire locally, or build a global team.

The firms that do this well are the ones that stay prepared for growth. They are not just saying yes to new work and hoping for the best. They are creating space for their teams to succeed and building a foundation for long-term results.

Planning capacity is not just an operational task. It is a core part of running a strong and scalable firm.

Did you know?

93% of firms struggle to find experienced accountants and bookkeepers. AccountGlobal gives you access to dedicated professionals who bring years of industry experience and work exclusively for your firm.

Book a callStay informed about tax law changes in Australia:

To ensure you are always aligned with current regulations, it's important to stay informed about the latest tax law updates. Here are some reliable Australian sources to help you stay up to date:

- Australian Taxation Office (ATO): The ATO provides official updates on tax legislation, rulings, compliance obligations, and administrative changes through newsletters and bulletins.

- The Tax Institute: As a leading voice in Australia’s tax profession, the Tax Institute shares detailed insights, technical updates, and commentary on new legislation and policy reforms.

- CPA Australia: This professional body offers members regular updates on taxation, superannuation, and regulatory changes, along with practical guidance and analysis.

- Chartered Accountants ANZ (CA ANZ)Chartered Accountants ANZ (CA ANZ): CA ANZ delivers weekly briefings, policy updates, and tax news tailored to the needs of accounting professionals across Australia and New Zealand.

- Thomson Reuters Australia: Thomson Reuters provides detailed analysis, commentary, and expert-led updates through platforms such as Checkpoint and its Weekly Tax Bulletin.

- Accountants Daily: A go-to publication for Australian accounting professionals, Accountants Daily provides timely news, expert analysis, and industry updates on tax, compliance, and regulation.

Let go of clients that drain resources:

Not every client is a good fit for your accounting firm. Some take up more time and resources than they are worth, adding stress without contributing to your bottom line.

Before the busy season begins, take a close look at your client list. Identify those who consistently overextend your team, require constant hand-holding, or fail to bring in enough revenue. If they are not profitable, it is time to either reset expectations or let them go.

Working with fewer but better-aligned clients allows your firm to focus on quality service, improve team efficiency, and create space for more valuable growth opportunities.

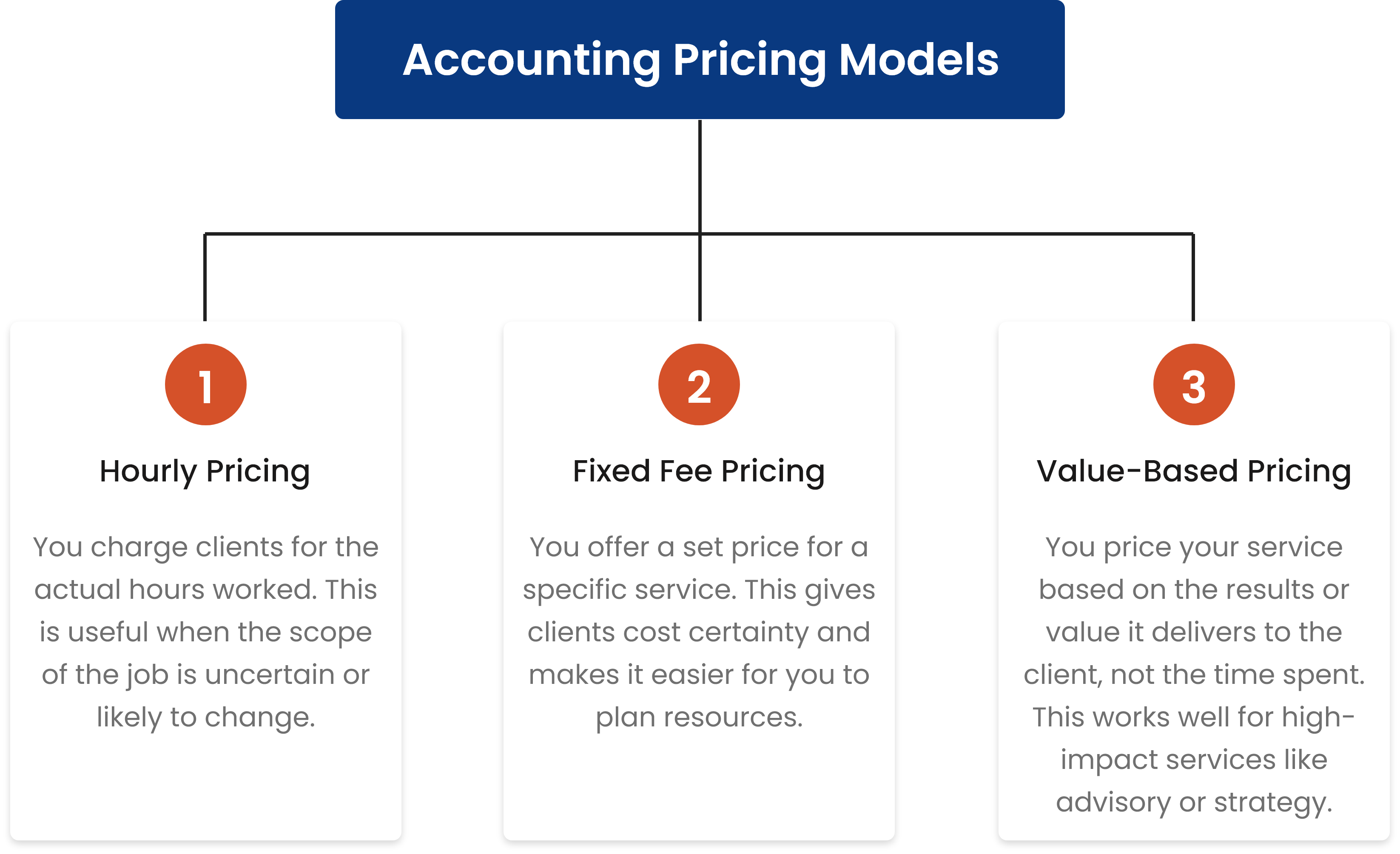

Set your pricing strategically:

Choosing the right pricing model helps you capture the real value of your expertise while shaping how clients perceive and engage with your services. Here are three strategic approaches to consider:

Review your core processes early:

Reliable systems are the foundation of an efficient accounting firm. When your core processes are clearly defined and consistently followed, your team can work faster and make fewer mistakes.

Any gaps in your workflow will slow you down, especially when your team is operating at full capacity. Take the time before the busy season to review and refine your key processes. The more smoothly they run, the easier it will be for your team to handle high volumes without unnecessary stress or disruption.

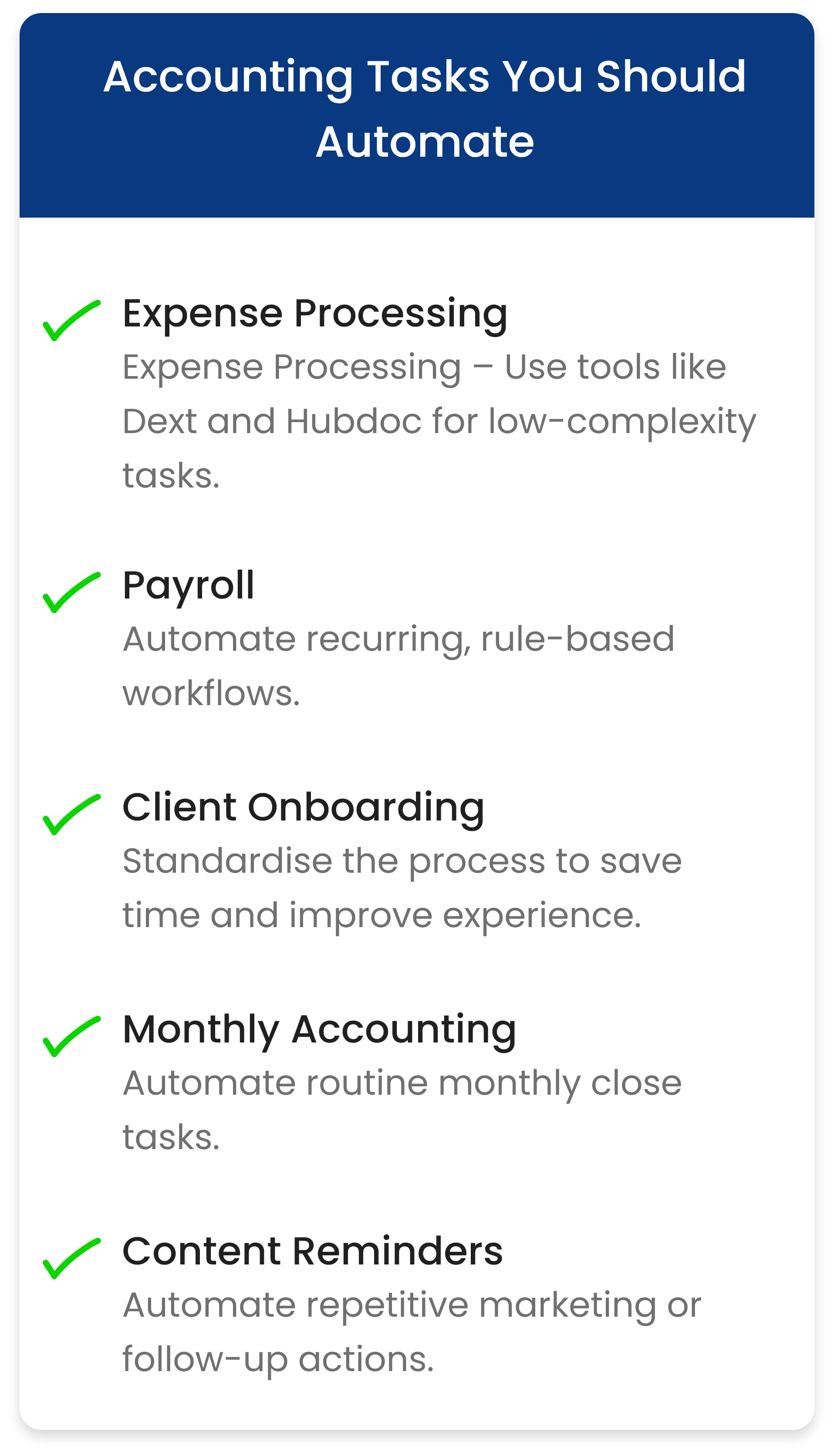

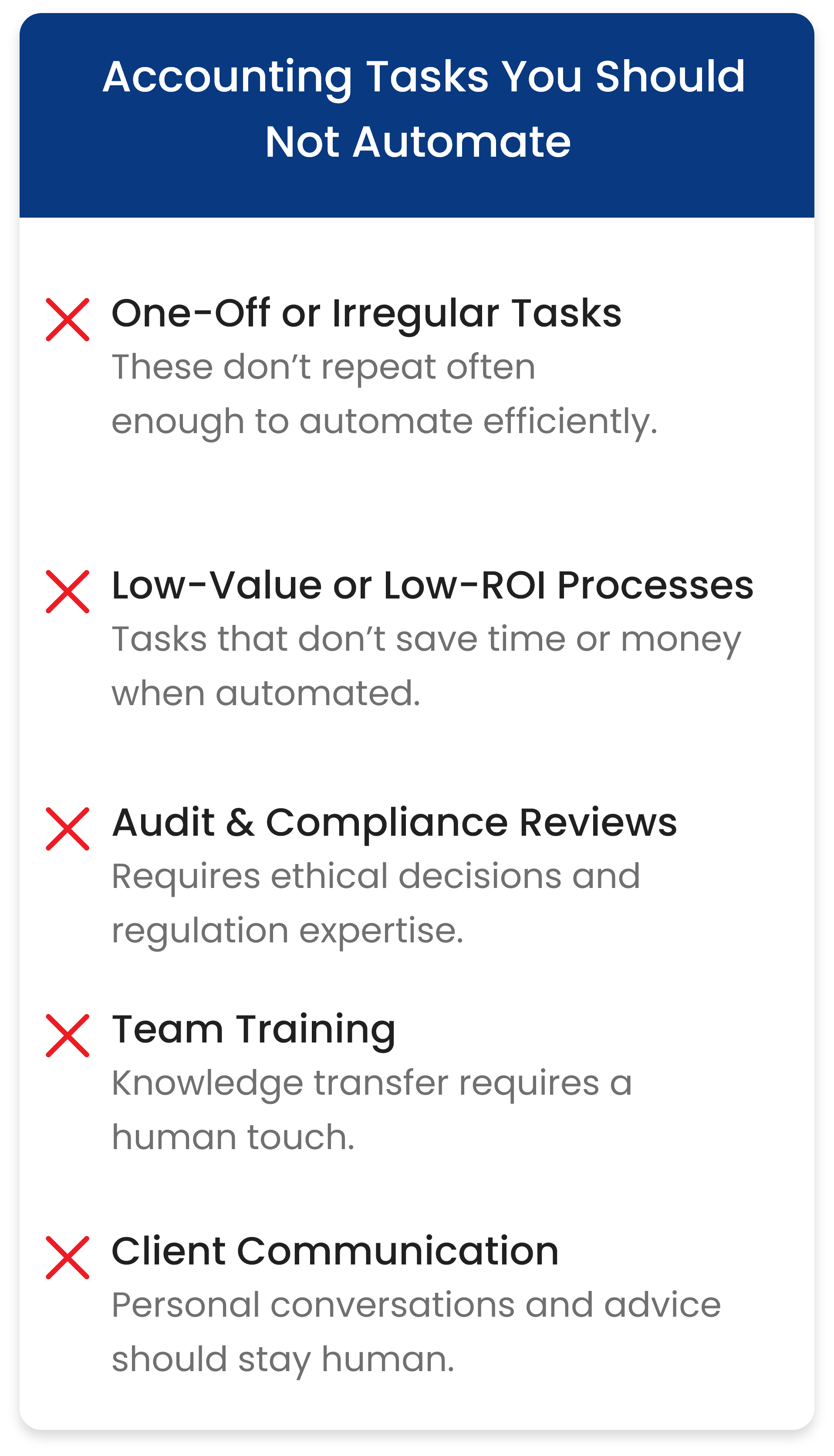

Make automation work for your firm:

Automation is quickly becoming the backbone of accounting, but it is important to approach it with clarity and purpose.

Start by reviewing the tasks your team handles each day. Identify what is repetitive, takes a lot of time, or is often done manually. These are the areas where automation can help you work faster and more accurately.

The focus should not be on using more tools, but on choosing the right ones. Look for solutions that reduce manual work, remove double handling, and make the overall process easier to manage from start to finish.

When used effectively, automation gives your team more time to focus on client service, improves accuracy in your data, and increases overall productivity. It helps your firm handle more work without increasing pressure on your staff.

Start with one task that slows things down. Over time, small changes lead to a more efficient and scalable way of working.

Replace meetings with Loom:

Did you know? The average professional spends around 5 hours and 6 minutes each week in meetings, and nearly 4 more hours just preparing for them. That’s almost 10 hours every week dedicated solely to meetings — time that could be better spent on focused, productive work.

For accounting firms and busy teams, that’s a major drain on efficiency.

Loom offers a smarter way to communicate. Instead of scheduling another meeting, record a quick video to walk through updates, demonstrate a process, or deliver feedback. Your message is clearer, and your team can watch it when it suits their workflow.

Companies like Atlassian used Loom to replace 43 percent of their meetings and saved over 5,000 work hours in just two weeks. That’s a massive gain in both time and productivity.

Loom integrates easily into daily operations and is ideal for team updates, client onboarding, training walkthroughs, and more. Plus, it offers a free version, making it simple for teams to try without any commitment.

If your calendar is full of unnecessary meetings, it might be time to switch to a tool that gives your time back.

Outsource what you shouldn’t be holding onto:

Trying to handle everything yourself quickly leads to exhaustion and slows down your firm’s growth.

Many firm owners avoid outsourcing because they believe only they can do things the right way. But trying to make every detail perfect often adds unnecessary pressure without improving client outcomes.

Clients value accuracy, clear communication, and timely delivery. They are not concerned with how you format reports or structure line items.

Outsourcing routine and time-consuming tasks to skilled professionals frees up your time and lifts the weight off your shoulders. You will get the work done well, without being stuck doing it yourself.

The more you try to control everything, the more you stay stuck in daily operations. To grow your firm, you need to shift your focus. Stop working in the business and start working on it. Outsourcing is a practical step that helps you make that shift.

Thinking about outsourcing but not sure where to start?

Grab our free ebook for a clear breakdown of what to outsource, how to choose the right partner, and how to align your team for lasting results.

Make space to recharge:

When the workload increases, your own well-being is often the first thing to be pushed aside. But without it, everything else suffers.

Unchecked stress can reduce your ability to focus, affect decision-making, and lower the quality of your output. Over time, this impacts not just your health, but your relationships with clients and your team.

Sustainable performance comes from balance, not overwork. Protecting your physical and mental health allows you to meet demands without losing momentum. Self-care is not a pause from progress. It is what keeps you moving forward with clarity and control.

Final thoughts

If this article gave you new ideas for managing the accounting busy season, you're already on the path to working with more structure, less stress, and better results.

The key is building the right systems and having the right support in place. This is where AccountGlobal can help.

We partner with accounting firms across Australia, providing access to experienced offshore accountants, bookkeepers, SMSF specialists, and tax professionals trained in line with ATO standards. With local account managers and a fully managed process, we make it easy to expand your team without the usual complexities.

Here is what you can expect from working with us:

- Access to qualified professionals who integrate smoothly with your team.

- Lower 70% on operational costs while maintaining high standards of work.

- Keep your data protected with ISO 27001-certified security.

- Flexible, scalable support that grows with your firm.

Whether you are looking for part-time assistance or a full offshore team, AccountGlobal is here to support your firm through the busy season and beyond. Book a free consultation call today with our expert team.